Hey folks!

For those who missed our video yesterday on the Tata Tech IPO (because the link was dodgy). Here you go. This one works. And with that niggling detail out of the way, let's get to today's edition, shall we?

Happy new financial year! 🎉It’s time to start worrying about how much tax you need to shell out for last year’s earnings. Time to plan how you’ll splurge your newly credited vacation leaves. And also time to think about how to spend and save better.

But ever asked yourself why we wait until April to start a new FY? Why don’t we simply sync with the calendar year?

To begin with, there’s the obvious British influence. Until about the 14th century, England followed the Julian calendar. According to this calendar, the last day of the year fell on the 25th of March.

But it had to be replaced by the Gregorian calendar because the Julian calendar didn’t correctly reflect the actual time it took for the Earth to go around the Sun. During this switch, March 25th on the Julian calendar coincided with April 5th on the Gregorian one. And April 6th to April 5th (of the following year) came to be England’s FY from then on.

When the East India Company set foot in India they learnt how April marked Vaisakh or the first day of Spring harvest in the north. That also almost coincided with the crop cycle. And since most of the Colonial Government’s taxes came from crops, they thought it best to have an April-March FY.

So you could say that this is one of the many things that the British left behind.

Another practical reason behind this odd FY is to simplify stock taking or assessing how much inventory businesses have at the end of the year. See, India celebrates its favourite festivals like Navaratri, Pujo and Diwali around October or November, followed by Christmas in December.

Festivals are high sales periods for vendors. There’s a lot of business activity that keeps them busy and buzzing. If the FY ends during a time like this, closing books of account could be a sordid mess.

The safer option? Continue with the April to March FY. Easy, no?

Here’s a soundtrack to put you in the mood 🎵

Baat Itni Si Hai by Twin Strings

A shout out to our reader Kumar Garv for this mellow melody.

Ready to roll?

What caught our eye this week 👀

Is Sleepy Owl Coffee Surreal doppelgänger?

On Friday, Sleepy Owl Coffee ran a quirky brand campaign. They claimed that Amit Ji drank their coffee and that Pathaan loves it.

Now, you’d think that they’re talking about Amitabh Bachchan and Shah Rukh Khan. Not just because of the references but even because of the pictures on their outdoor hoardings. Until you read the quirky disclaimers in brackets below which read “Ibrahim loves being called Pathaan” or “Not the Amit Ji you’re thinking about”.

So these brand ambassadors aren’t real celebrities but rather lookalikes who’re grabbing people’s eyeballs.

Now here’s the thing. This ad is an altered copy of a similar campaign by a UK cereal brand called Surreal. Although Surreal didn’t use celebrity doppelgängers they still said stuff like “We’re Dwayne Johnson’s favourite cereal*”. Followed by “*Dwayne is a bus driver from London”.

Is that a problem, you ask?

Well, may not be. Because despite the lack of originality, Sleepy Owl gave a shout out to Surreal for their ad inspiration. At least on social media.

But here’s the real problem that Sleepy Owl smartly dodged with this ad ― celebrity rights.

See, we don’t have specific laws in India to protect famous personalities from publicity which they didn’t permit or ask for. But the Advertising Standards Council of India (ASCI) has a Self Regulation Code which recognises the exploitation of well known personalities’ public images in ads.

So, if brands or people use celebrities’ photographs, voices or names to mint money the latter could drag them to court. Amitabh Bachchan did that last year. Thousands of random folks were running lotteries using his name and KBC posters. Or creating voice chat apps that claimed that you could talk to a chap who sounded like him.

And since Big B can’t go and pull out every Tom, Dick and Harry doing this, his counsel requested a John Doe action. Meaning, nobody can use Big B’s personal traits for their personal gains. You could be behind bars if you do.

So, hairdressers and auto rickshaw drivers sticking celebrities’ faces on their banners could be pulled up for crime!

But Sleepy Owl cannot because it hasn’t used real celebrity names or images. Maybe.

We’ll have to see what the real celebrities think of this gimmick now.

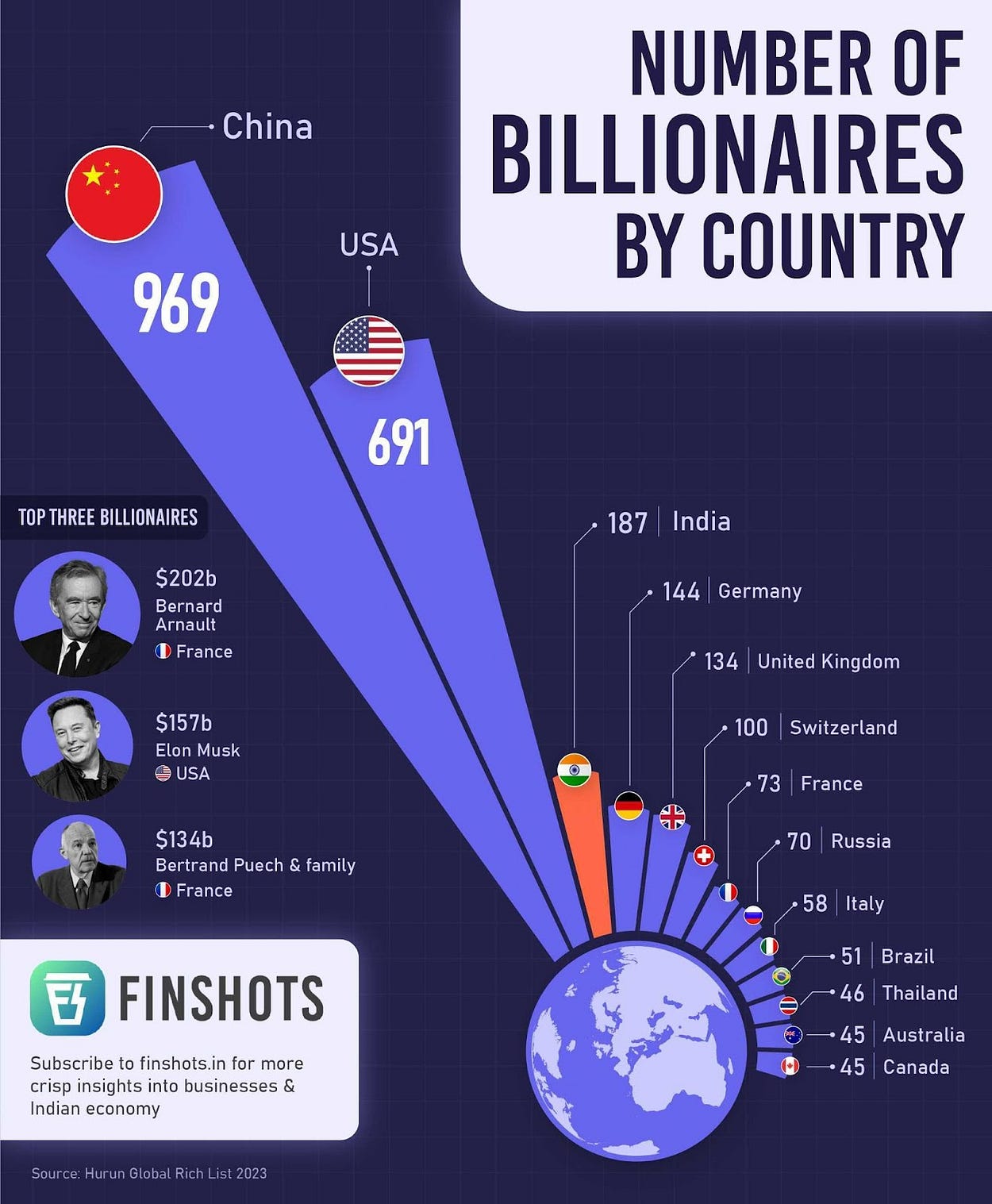

Infographic 📊

Quirkonomics 💸

The Greater Fool Theory

Yesterday wasn’t just the beginning of the new financial year. It was also April fool’s day. So, we thought of aligning our newsletter with it and talking about a theory which involves fools in the stock market ― the Greater Fool Theory.

But before we dive into it, let’s talk about market bubbles. For the uninitiated, a market bubble is a period when over-the-top optimism pushes up stock prices so much that they even outdo their market value.

Just think of how the Indian markets performed in 2021. Right after the second wave of COVID weakened, people regained their confidence in the market. The BSE SENSEX reached its peak and breached 62,000 points for the first time.

But most stocks in which folks like you and me invested were trading beyond the real prices they were worth.

Now, in a market bubble like situation stocks just keep rallying. So you could profit from buying overvalued stocks and selling them at an ever higher price to someone else, simply because they’re willing to pay. It’s almost like betting on future stock prices without really considering fundamentals such as price to earning ratio of the company, its valuation, etc. And that you’ll always be able to find a “greater fool” who’ll be willing to pay more than you did.

Unfortunately, when the bubble bursts which it always does, investors panic; triggering a huge sell-off. This pulls down stock prices and can cause the market to crash. If you are the one holding the bag at this time because you can’t find a greater fool to buy your stock then sadly you’ll be a chump losing more money than you made from the speculative bubble.

So don’t get swayed by irrational enthusiasm in the stock market if you haven’t done satisfactory research that backs your trade. We’re not saying that analysis is fool proof. You could lose your money here too. But at least you won’t be a victim of the Greater Fool Theory.

Money tips 💰

The 30-Day Savings Rule

Often we buy a lot of things we really want. But do we always take out the time to evaluate if we really need them?

Maybe not.

That habit can quickly add up and translate into constant impulse purchases because of which we might postpone necessary payments. To put things in perspective, imagine that you badly want to buy a pair of new shoes. Despite the purchase overstepping your monthly budget, you go for it.

And just so that you don’t go broke you request your landlord to defer your rent payment. Or even worse, you might decide to pay only the minimum amount due on your credit card and carry forward the rest. In both situations you’re inviting an additional cash crunch next month, plus a huge interest burden too.

But what if you were to follow the 30-day savings rule?

Here, you wait for 30 days before you actually decide to buy something that isn’t absolutely necessary. This way, you not only give yourself time to mull over the purchase but also push yourself to save by avoiding other unwanted buys.

See, impulse buying is an emotional decision. So, when you follow the 30-day savings rule you kick the emotion out of the picture.

At the end of it you’ll end up with one of the two results.

- Realise that you can do without those pair of shoes.

- Or have some money saved because you felt that you really have to get them.

What do you think of this saving hack? Let us know.

Readers Recommend 🗒️

Five people you meet in heaven by Mitch Albom

Today we have a book recommended by our reader Ayushee Prajapati. Thank you Ayushee!

This book is about a protagonist named Eddie who thinks that he has lived an uninspired life only to die and wake up in his afterlife realising the secret behind the eternal question: “Why was I here?”

Finshots Weekly Quiz 🧩

It’s time to announce the winner of last Sunday’s Weekly Quiz. And the winner is… 🥁drumroll… Abhilash! Congratulations. We’ll get in touch with you soon to send the merch we promised.

Meanwhile, here’s a message to all the other winners. Please don’t forget to check your e-mail and respond, so that we can send your goodies across at the earliest.

To the rest of you who’re brazing to win, here’s your next chance. Click this link to access the Google form and take the quiz. And tune in next week to see if you won.

With this, it’s wrap up time.

Until then, don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: ).

Ciao!