In today’s Finshots, we discuss why the CCI (Competition Commission of India) took MakeMyTrip and OYO to task.

The Story

Last week, the Competition Commission of India (CCI) slapped massive penalties on two companies you know very well — MakeMyTrip India Pvt. Ltd. and Oravel Stays Pvt. Ltd (OYO). Both entities were fined ₹223 crores and ₹169 crores respectively.

But why?

Well, the story dates back to 2019 when FHRAI (Federation of Hotel & Restaurant Associations of India), Treebo and FabHotels took MMT-Go (the merged entity of MakeMyTrip-Go Ibibo) and OYO to the CCI. They accused MakeMyTrip of colluding with OYO, abusing their dominance, and controlling prices in the market.

But alongside these sweeping allegations, there were 3 main concerns

1: MMT-Go enforced price parity in its agreement with hotel partners. So if the likes of Treebo and FabHotels intended to list one of their properties at a lower price with a different aggregator or on their own website, they weren’t allowed to do so.

2: MMT-Go was indulging in “predatory pricing” i.e. they were offering extremely deep discounts on room rates in a bid to corner the online travel agent (OTA) market.

3: MMT-Go also extended preferential treatment to OYO and restricted FabHotels and Treebo from accessing India’s biggest OTA platform.

There are also other allegations in the complaint. But as we noted, these are the three primary concerns.

And with that out of the way, we can now look at the 131-page order or at least highlight the most interesting parts.

First, you have to remember that all these allegations mean very little if the complainants fail to establish that MMT-Go is a market leader. After all, you can’t really abuse market dominance if you aren’t the biggest player in the market.

So, is MMT a dominant force?

Well, here’s MMT’s point of view. They believed the total market should include both online and offline channels. They also believed it should include direct hotel websites alongside Search, Discover, and Book (SCB) platforms like Google. In totality, they wanted the CCI to consider everything when deciding the relevant market here.

The hope was that this would automatically cut down their share in the market considered.

But CCI didn’t quite agree with this assessment.

It said these arguments were ‘misconceived and self-serving, despite the degree of sophistication with which they have been presented’. And then used MMT-Go’s own research report from a couple of years ago to make its point.

People who book hotels online are distinctly different from those who talk to a rikshaw driver to find a hotel. These markets are mutually exclusive and the two modes don’t really cater to the same kind of customers.

Also, most hotels listed on OTAs don’t have their own websites. They don’t have a loyal customer base and they’re seeking visibility when they go on these platforms. In fact, MMT-Go’s own report states that unbranded hotels formed 72% of its inventory in 2018. So direct website bookings were unlikely to form a major chunk of the relevant market.

And finally, the Search, Discover, and Book argument with Google.

CCI used screenshots from a report published by MMT-Go to prove that the tech giant wasn’t a threat. While Google allowed comparisons on its search website, customers couldn’t really book a room on the search engine. Instead, it typically redirected you to the OTA itself. And OTAs could run ads to feature on top of the search results. It was a marketing platform and not necessarily a distribution platform. However, MMT made most of its money when somebody booked a room through the platform. So in some ways, they distributed the inventory. And their own report stated that Google directed 42% of all traffic to its website.

So at the end of it all, the CCI noted that the relevant market consists only of ‘online intermediaries for booking hotels in India’.

And what’s MMT-Go’s market share here?

Well, once again they relied on a screenshot published by MMT-Go. They noted that the company had a 63% market share in the online market as of 2017. They also noted that there were no new entrants in the OTA market after it acquired Go Ibibo in 2017.

Bottom line — MMT had a dominant presence in the relevant market, at least according to the CCI.

Next, we move on to Price Parity, Deep Discounts, and Predatory Pricing issues.

OTAs indulge in price parity agreements all the time. It’s not just MakeMyTrip. So if you were setting up your own platform you’d have likely fleshed out a similar agreement with hotels and hotel chains across India.

But CCI believes these contracts are inherently anti-competitive.

For instance, assume there’s another low-cost OTA platform that intends to disrupt the market. It promises to charge a lower commission compared to the incumbents. And then negotiates a better price with the hotel. But if it really wants to offer this bargain price to customers, it can’t. Because then the hotel is bound to offer MakeMyTrip the same room at exactly the same price because they have a contract that stipulates this arrangement.

And let’s suppose both MMT-Go and the new entrant now get to list this inventory at this fixed price. From here on in, both platforms can exercise discretion on whether they want to extend further discounts on this “set price.” And this is where MMT’s deep pockets can really do the damage. They can discount the price considerably since they dominate the market.

For instance, as per the CCI report:

“The data on room nights on which discounts are provided indicates that largest number of room nights on which more than 30% discount is provided are booked through MMT-Go. Expedia has submitted that average discount provided by Expedia from 2013–2019 was on an average below 5%.”

And CCI believed that MMT did this not to attract new customers but to drive out competition.

But is this predatory?

Well, to determine this, CCI would have had to show that MMT-Go was discounting the rooms below cost. And since they weren’t entirely happy with the calculations, they gave MMT a pass on the issue.

And finally, the concern with OYO.

Both MMT and OYO conceded that they had exclusive agreements in place to delist other franchisee hotels. But they argued that this was a purely economical enterprise.

For instance, MMT looked at growth metrics from Treebo, FabHotels, and OYO during 2016–2018. During this time, OYO wasn’t listed on MMT, but the others were. And while OYO managed to grow exponentially, the others were still struggling to make a dent. So MMT recognised the need to have OYO on its platform and then took the conscious decision to delist Treebo and FabHotels since OYO insisted on it.

But did that put the others out of business?

Well, OYO points out that it had no impact on FabHotels’ revenues. And Treebo’s revenue jumped from ₹4.6 crores at the time of delisting (April 2018) to ₹6.1 crores by December 2019. So where was the impact?

Case closed?

Not quite. Because here’s the thing. As per the CCI, “More than the harm to a competitor, the Commission is more concerned about the harm to the competitive process.”

Let us explain.

See, the CCI’s contention is that budget and independent hotels find it hard to get their name out there. That’s why they tie up with franchisee service providers such as OYO, Treebo, and FabHotels in the first place. This gives them some degree of recognition and visibility while also helping them list on platforms such as MakeMyTrip.

But if Treebo and FabHotels are prohibited from the platform, it hurts every independent hotel owner that trusted the franchise in the first place. They would have to sever existing ties with Treebo and FabHotels and join OYO’s fold. They’d have to switch and incur all costs associated with switching too. And it wasn’t even their fault. Or even Treebo’s or FabHotels’ for that matter.

And customers would only see OYO hotels. They’d have limited choice in all this.

That’s the problem. That’s the competitive process CCI is alluding to.

Which explains why CCI came down hard on both MakeMyTrip and OYO and slapped a hefty penalty.

And the big blow?

Remember the price parity agreements we spoke about earlier?

CCI wants MakeMyTrip to get rid of these agreements. That means it can’t ‘set’ the prices it wants. So if a hotel wants to offer a room to Booking.com at a lower rate, it can. It won’t be shackled by MakeMyTrip’s rules anymore.

So yeah, that’s the story.

Until next time…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter

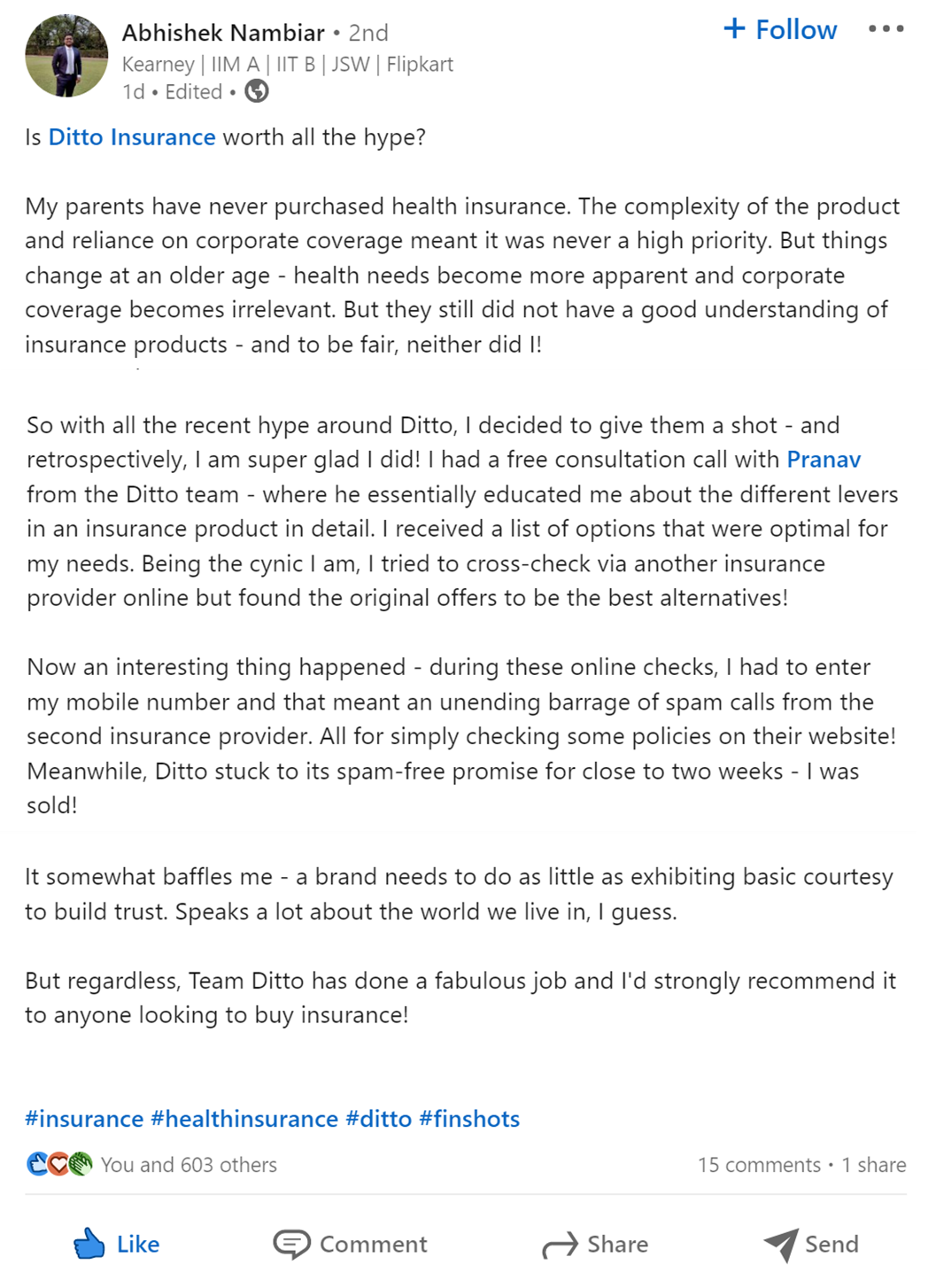

Ditto Review: Experience the hype

Don’t forget to insure your loved ones this festive season.

1. Just head to our website — Link here

2. Click on “Book a FREE call”

3. Select “Health Insurance" or "Term Insurance”

4. Choose the date & time as per your convenience and RELAX!

Our advisors will take it from there!