Hey folks!

If you’ve found Amul butter missing from grocery store shelves, you may not be the only one. There’s a real shortage of butter in India!

And the reason is Diwali…

Weird?

Well, here’s the thing. We had a close-to-normal festive season this year after two long years of pandemic-driven curbs. Families and friends were gathering around and this meant that mithai was in unusually high demand.

Now, Amul normally uses 60% of the fat it derives from its initial milk procurement to produce liquid milk. The rest goes into making stuff like butter, ghee and cheese. But this time, the demand for sweets was so high during Diwali that Amul had to tweak things. It used up more milk fats to produce more liquid milk ― the main ingredient in milk cakes and malai pedas. And well, butter and ghee took a back seat.

Then, we had the ‘lumpy skin disease’. Remember that from a couple months ago? Well, India’s cattle suffered and 60,000 cows succumbed to the illness this year.

Also, dairy exports increased by a staggering 95% compared to the last year. It left little for local consumption and was quite a double whammy.

And Amul’s not the only one. Even Mother Dairy also seems to be in a similar spot.

But fret not. The folks in the dairy business are confident that this butter stock problem is only short-lived.

Until then you might have to simply have unbuttered toast for breakfast. 🍞

Here’s a soundtrack to get you in the mood 🎵

Courtyards by Shourya Malhotra

Come now, let’s slide (like butter) into the weekend..,

What caught our eye this week 👀

Tough to kill the Maharajah

After spending nearly $1 billion to create the Vistara brand in the past 8 years, its owners have decided to dump it!

That’s right, the airline jointly owned by Singapore Airlines and the Tata Group has decided that it’s best to simply merge Vistara with Air India. And well…call it Air India!

Okay. Why on earth would they do that? Air India’s staid and boring and doesn’t really appeal to the young demographic. Vistara’s the cool one. So why?

For starters, it could be the global ambitions. You see, although Vistara made it to Skytrax’s (a UK based airline and airport review and ranking site) Top 20 carriers list of 2022, it just flies 15 international routes. Air India, on the other hand, flies over 70. With an international market share of about 12%, Air India already has an international brand name. Something Vistara doesn’t.

Or maybe it’s simply because Tata does not want to give up on its legacy?

A legacy that began on 15th October 1932. A 28-year old Jehangir Ratanji Dadabhoy (JRD) Tata climbed aboard a single-engine plane and took to the skies. His destination was Chennai (then Madras) and he intended to reach his destination after a brief stop at Mumbai (then Bombay). With him, he also carried a small pouch of airmail. It read — ‘First Flight Madras-Karachi Airmail Service.’

And thus…Tata Air Mail had arrived.

Before you knew it, the airlines went from ferrying mail to ferrying passengers. Within six years, the company owned 15 planes. And it was renamed, Tata Airlines. By 1946, it carried one in every three passengers in India and owned 50% of the country’s fleet. The same year, it became a public company and adopted the name we’re all familiar with — Air India. Also, that’s the year in which the famous Air India mascot of a moustachioed, turbaned man known as the Maharajah was created.

Tata had created the king of the Indian skies.

But well, the story goes that the government took over the airline in the 1960s, Tata exited. And it all went downhill from there.

Now, after taking it back from the government, you can see why Tata would want to keep Air India’s storied history and dump the young Vistara, no? It might simply want to bring the brand back to its former glory. It has roped in London-based Futurebrands (which has worked on rebranding American Airlines and Bentley in the past) for its makeover. And who knows…Air India may even have a new mascot replacing the aged Maharajah.

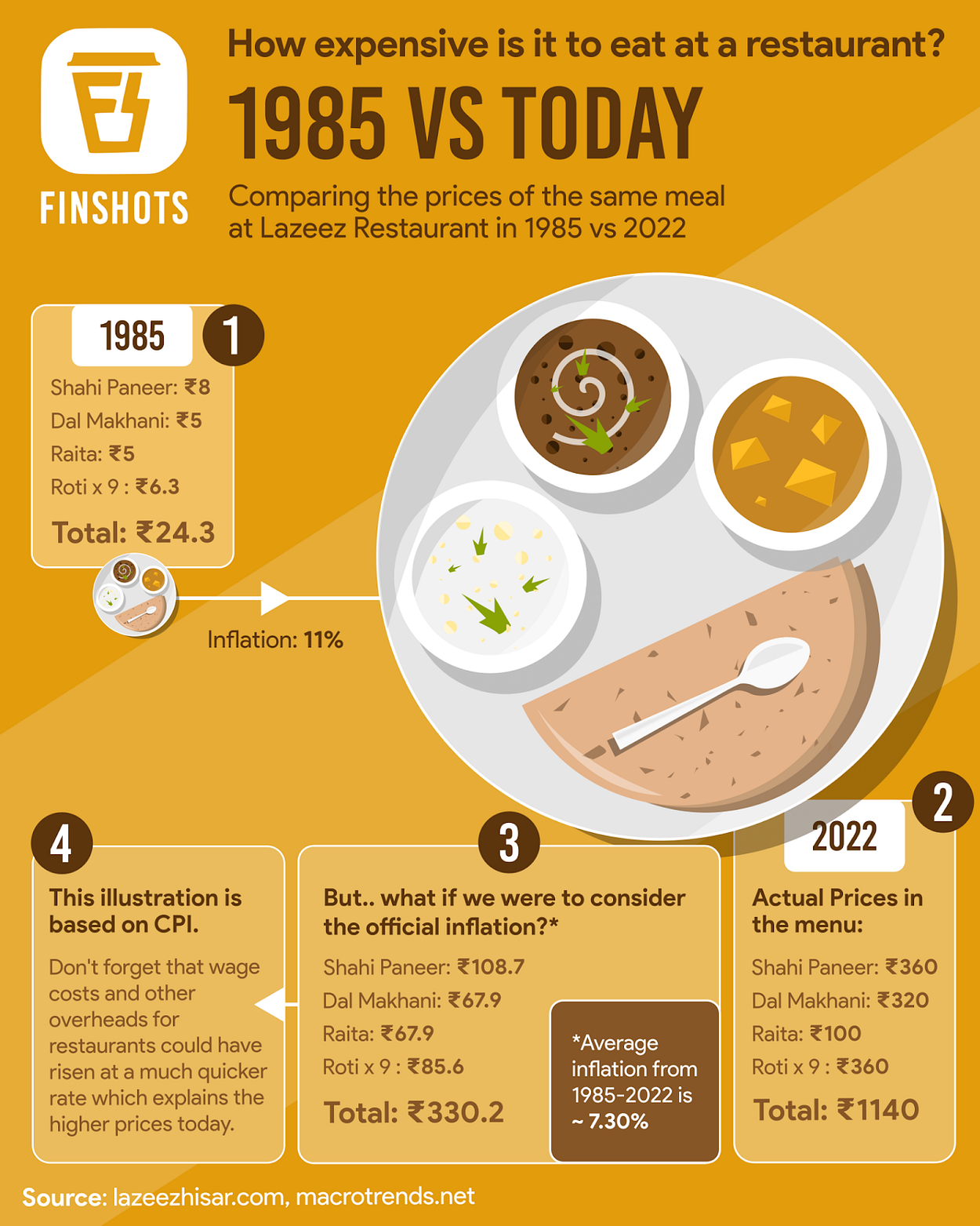

Infographic 📊

Quirkonomics 💸

Brushing teeth could earn you more money. What?!!

What if we told you that there’s a relationship between how much you earn and how frequently you brush your teeth?

Don’t believe us?

Well, in 1974 economist Alan Blinder published a paper titled ‘The Economics of Brushing Teeth’ in the Journal of Political Economy which observed that people who earned less, brushed more.

The logic was simple. And the assumption based on the human capital theory which asserts that people do whatever they do, to maximize their income. In this case ― brushing teeth.

Think chefs and waiters working in a restaurant. Chefs are often working behind the scenes, while waiters have to be presentable to customers. Now if you have a person with bad breath or yellow teeth waiting to take your order at a restaurant, there’s a higher chance of the chap losing their tips.

On the contrary, chefs have none of this to worry about. And if you look at it, chefs bag a higher pay than waiters. So if waiters had to pocket more money, they had to well, take care of their teeth.

Another observation Blinder noted was of professors at a leading university. He found that assistant professors brushed 2.14 times daily on average, while associate professors brushed only 1.89 times and full professors only 1.47 times daily.

Notice the pattern? Higher the rank, lower the frequency of brushing teeth. Which meant that assistant and associate professors brushed more often than their seniors, so that they could get promoted and earn more.

Interacting with people with a bad breath can sure dampen your chances of going up the career ladder eh?

So, even if you argued that your brushing habit came from how much your mum pushed you into doing it, she still had an outlook of maximising your income when she told you so.

Money tips 💰

We’re giving Money Tips a fresh coat of paint. What do we mean?

Well, instead of doing bits and pieces of personal finance every week, we’re going to run a mini-series of sorts. That means, we’ll pick a topic for the month and talk only about it. Let’s see how it goes, yeah?

And what’s on the agenda for December?

Budgeting!

Yes, it’s boring. It’s tedious. It’s the worst thing you can do over the weekend. But unless you’re limitlessly rich, you need to keep a hawk-eye on these expenses. Haven’t you heard, “a penny saved is a penny earned”?

Who knows, it could fund your new iPhone or a backpacking trip in 2023!

So, we’re going to get down to brass tacks — Actually create a budget. To help you with all this, we’re giving you a free budgeting template (look at instructions on the Introduction sheet on how to download and edit it) as well.

Step 1: Download your bank statements for the year — savings account as well as any credit cards. Look at ATM withdrawals and try and remember things you’ve spent money on.

Step 2: Bucket these expenses into broad categories — Rent, Electricity and Water, Phone and communication, Groceries, Fashion, Personal grooming, Pet/Childcare, Food and drinks, Subscriptions (like Netflix), Transport (include fuel, Ubers, autorickshaws), House maintenance.

Step 3: Once you’ve done that, break it down even further. For instance, look at your “Groceries” category. How much did you spend on fruits, vegetables, and bread versus spending on snacks like biscuits and cakes?

Step 4: Don’t forget annual expenses. Say payments for your life or health insurance. The insurance and maintenance for your car or the scooter. Even taxes.

Step 5: There are also the dreaded variable expenses — when friends or family drop in! Dig into your statements and see how often these have occurred. And how much you spend on these occasions. Having a rough idea of this could save you some heartburn in 2023!

And there you have it, you’re now quite intimate with your expenses. :)

Oh, and there’s just one more thing…have you got an email from your HR asking you to submit your income tax proofs?

Well, don’t forget about a little something called ‘insurance’. Not only does it do the fabulous task of protecting you or your family when things go awry. But also, it gives you tax saving benefits: Under section 80C & 80D, you can reduce your taxable income by the premiums paid for life & health insurance respectively.

And if you need help figuring out the right insurance for your situation, you know where to find us!

1. Go to Ditto’s website — Link here

2. Click on “Book a FREE call”

3. Select Health Insurance or Term Insurance

4. Choose the date & time as per your convenience and RELAX!

Our advisors will take it from there!

Readers Recommend 🗒️

Own The Room by National Geographic/Disney+

This recommendation comes from our reader Suhani Tiwari.

And it’s a reality documentary that follows the journey of 5 students who’re competing to win at the Global Student Entrepreneur Awards.

That should be quite something!

***

Anyway, with this, we wrap up Sunny Side Up. And we’ll see you next Sunday!

Also, don't forget to share this edition on WhatsApp, LinkedIn and Twitter

Meanwhile, if you liked this newsletter or even if you didn’t, tell us by hitting reply to this email (or if you’re reading this on the web, drop us a message: ).

Ciao.