Hey folks!

Ever thought of how close the world is to doomsday?

You must’ve at some point in time at least. Maybe you wondered about it during your soul-searching moments. Or even did a world-ending countdown back in 2012 when the Mayan calendar predicted it. 😂

But, here’s something interesting. The world has a doomsday clock that tells us how close we are to the end of everything. It’s a metaphorical clock, of course. The closer it inches towards midnight, the closer we get to complete destruction.

And it all began back in 1947. An artist, Martyl Langsdorf, had to design a cover for the Bulletin of Atomic Scientists (a Chicago-based non-profit). Her husband Alexander was ironically a part of the team that developed the atomic bomb although he was vocal about the threats of nuclear weapons.

So, Langsdorf came up with the concept of a doomsday clock to warn people that our survival depends on how we address dangerous technological innovations. And she set the time to 11:53 pm. Why 11:53 pm? Because it looked good to Langsdorf’s eye (we’re not kidding!).

For the first few years Bulletin editor Eugene Rabinowitch decided how the clock moved. And when Russia exploded its first atomic bomb in 1949, he set the clock closer at 3 minutes to midnight. After his death, the Bulletin’s Science and Security Board took over the responsibility.

And now, after 3 years of staying 100 seconds away from midnight, we recently moved just 90 seconds away from it. The current time on the doomsday clock is the closest we’ve been to the world’s catastrophic end. Courtesy trade wars, worsening climate change and disruptive tech. And it’s high time we work towards turning it back.

The first time we successfully did that was in 1960 when tensions between the US and the Soviets eased, slowing down the nuclear war. And we’ve been able to move further away from midnight only 8 times in 76 years.

What can set the clock back this time? We’ll have to wait and find out.

Here’s a soundtrack to pull you out of that overwhelming thought 🎵

Dil Sitara by Umer Farooq & KMRN

We hope it worked its magic. Hop on then, shall we?

A couple of things caught our eye this week 👀

Cafe Coffee Day’s hidden money trails

Remember the allegations of the ₹3,500 crore fund diversion at Coffee Day Enterprises (CDEL) ― the operators of Cafe Coffee Day (CCD)?

Well, this week the SEBI decided to slap a ₹26 crore fine on it.

It seems CDEL’s 7 (out of 49) subsidiaries spread across businesses like cafes, real estate, software, power generation, hotels, coffee trading and coffee products had transferred these funds to another company called Mysore Amalgamated Coffee Estates (MACEL). And this was owned by CCD’s late founder V G Siddhartha himself.

But no one, even the board or the family of the late founder seem to know anything of it. The reason?

VGS managed all the funds and took decisions himself, sometimes even without appropriate shareholder approvals. CDEL didn’t even disclose all its material subsidiaries in its consolidated financial statements. So shareholders had no idea that these funds had even gone missing.

And although MACEL had declared back in 2020 that they’d used up nearly half of that money to repay their loans, investigation has now revealed that MACEL passed on over ₹3,000 crores alone to VGS through regular banking channels.

For what? Nobody knows.

It could be something to do with servicing his personal debts or investments. But those again are only speculations. Looks like the man who made us believe that ‘a lot can happen over a coffee’ has taken this secret with him to his grave.

***

Goodbye password sharing, hello jugaad

How many people do you share your OTT passwords with? At least everyone in your family, for sure no?

In fact, more than 100 million households globally use shared passwords. And Netflix alone could be losing $6 billion in revenue a year due to this love for sharing.

Now, the OTT giant has had enough. It lost nearly a million subscribers between April and July 2022 and decided that it had to launch a massive crackdown. It needs to make more money. And it’s going to do this through IP tracking.

So maybe, from March your siblings or friends who don’t stay with you won’t be able to access your Netflix account and may have to get their own.

Or is it?

Because as you know Indians believe in ‘jugaad’ or what you call innovative ways of problem-solving with least resources. So, rather than getting a new subscription, OTT lovers might just resort to piracy and watch unauthorised versions of OTT content. The result?

Netflix could actually lose a lot of Indian subscribers (as also global) rather than profiting from its new move. According to Mondaq (a New York-based content aggregator) advertising and subscription-based video streaming services are losing up to 30% of their annual revenue to piracy in India alone.

Does this mean that the OTT giant may have to rethink its strategy for India? What do you think?

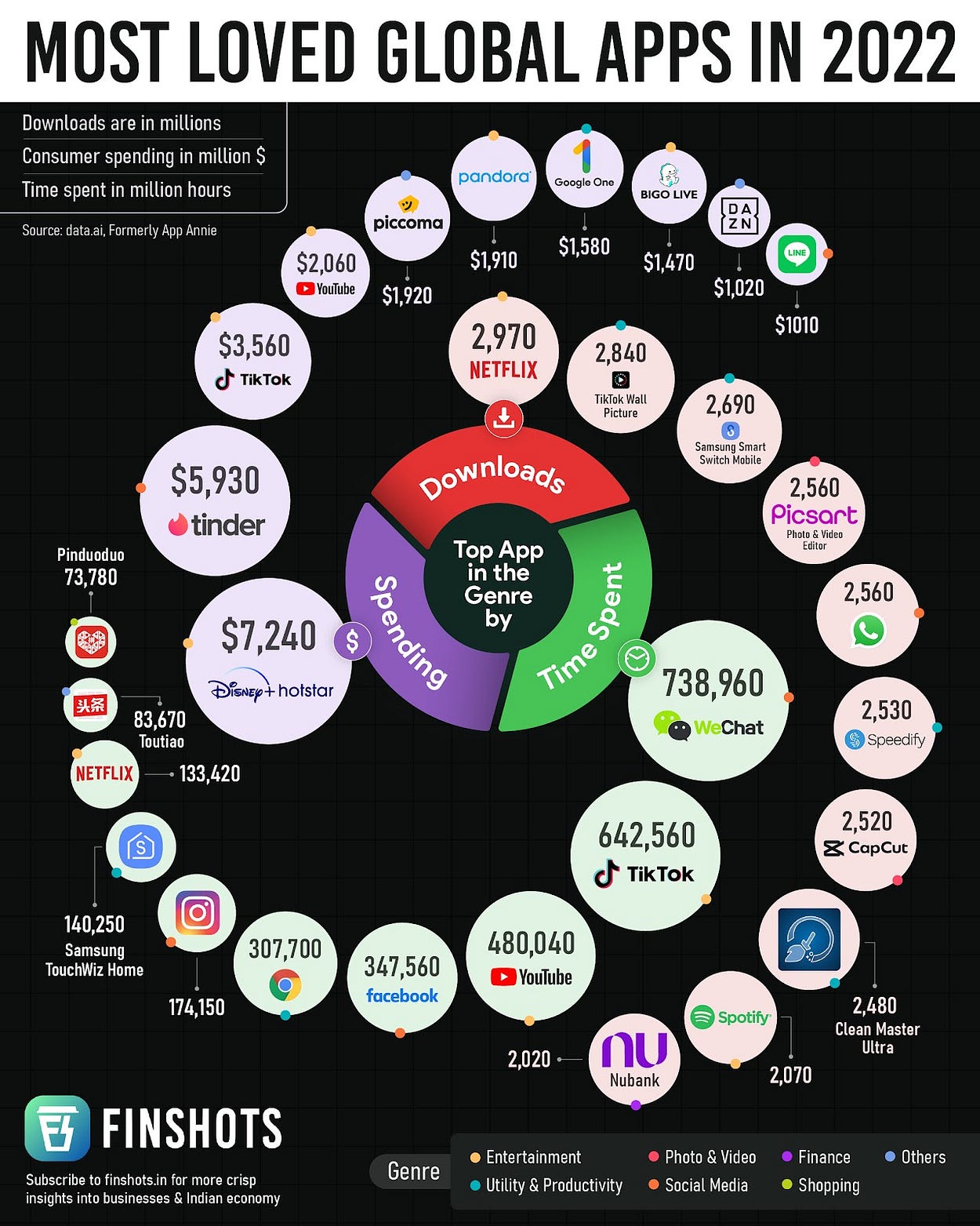

Infographic 📊

Money tips 💰

The risk of not investing

When you hear the word risk in an investing context what’s the first thing that pops into your head?

I’d assume it’s something to do with losing money.

Imagine a scenario where you’ve invested your money in stocks or mutual funds. Then there’s a market crash and you lose it all. You can already hear your heart beat louder in this imagined reality. You don’t want to stomach this kind of risk. So you decide to simply stick to safe investments. Like FDs.

After all, you know that the magic of compounding works in almost any kind of investment. Whether it’s the humble fixed deposit or the hallowed mutual fund.

But what if I told you there’s another type of risk?

It’s not the risk of losing money. It’s the risk of not meeting your goals.

You see, an FD is safe. The money lies with your bank and as long as it’s one of good repute, you don’t really have to worry about it going bankrupt and swallowing your money. But because it’s considered to be relatively safe, you can’t expect very high returns either. It barely keeps up with inflation. And then there’s the tax you have to pay on interest as well. So it may not be the best choice to grow money. Or build wealth.

The only way you can meet your goals is if you stay on the hamster wheel — work hard, earn more, save more. And then use those savings.

But what if you invest your money sensibly?

You take on some amount of risk that helps you get to your goals. You invest in stocks or mutual funds that might seem risky on the face of it. But over a long period of time, it rewards you for your patience. You beat inflation and then some.

Because remember, at some point in life, your income will end. But your expenses continue. Investing in assets that can build long-term wealth for you is the only real way to meet those expenses. Not doing so is what’s risky.

Readers Recommend 🗒️

“Why Didn’t They Teach Me This in School?” by Cary Siegel

Here’s a book that has a title that probably most of us have asked ourselves when we had to deal with taxes or all things that scream ‘adulting’. And we’ve got this great recommendation from our reader Siva Ramakrishna.

He says “This book is actually underrated and under-appreciated for financial lessons. This book focuses more on saving money and delayed gratification. Since you guys have a lot of young readers, some of them may hope to take some positive and valuable lessons from this book in their financial journey.”

We hope it does Siva. Thank you for your suggestion.

And don't forget to share this edition on WhatsApp, LinkedIn and Twitter

***

This marks the end of today’s weekend edition. We’ll be back next weekend with exciting stuff as always.

Don’t forget to tell us what you thought of today’s newsletter. And send us your book, music, business movies, documentaries or podcast recommendations. We’ll feature them in the newsletter! Just hit reply to this email (or if you’re reading this on the web, drop us a message: ).

Enjoy the rest of your Sunday! See you.