Typically, we like to dive into the history of a company to see how it got here. And then attempt to fathom what the future could hold. But enough has already been written about how MRF grew its business since the time of India’s independence.

So in today’s Finshots, we thought we’d look at this historic 1 lakh mark through a different lens and offer some theories for you to mull over.

The Story

Earlier this week, MRF’s shares hit the magical 6-figure mark. It’s the first company in India to achieve this feat and everyone’s going berserk and celebrating the moment.

Now we’re not going to analyze whether the stock is actually "expensive" or cheap.

Rather, we want to tell you why MRF is probably the ‘chosen one’ to hit this fabled mark.

Sure, one reason is that the company has delivered consistent growth in revenues and profits over the years. But so have a lot of others. So what if we were to posit that it's the first to hit this mark because it hasn’t indulged in a practice adopted by most other companies — a stock split?

Think of it this way. Assume that a company has issued 100 shares. These shares trade in the market for ₹100. Now the company might decide that it looks too expensive to investors. So, it announces a 10:1 stock split.

This means that if an investor held 1 share of the company worth ₹100, they would wake up one day and find that they now have 10 shares worth ₹10. The investment is still worth ₹100. The overall value hasn’t changed. But, the shares ‘look’ cheaper and become attractive to some investors. It could drum up interest and raise the prices.

And most companies resort to this — HDFC Bank and Reliance Industries included. So maybe if these biggies had never resorted to a stock split, they would’ve been the ones who'd first breached the ₹1 lakh mark?

We don’t know. But this brings us to the next question — why didn’t MRF ever choose to split its shares? The last time it resorted to something akin to a stock split was way back in 1975. So didn't it want to see a mad frenzy for its shares?

Well, we couldn’t find any interviews from their top brass that spills the beans. The reason for this isn’t explicitly out there. So we’ll speculate a bit. And we have a couple of theories.

Maybe it is sentiment?

Take the case of Warren Buffett who has never split the stock of his company Berkshire Hathaway. It trades at over $500,000 (₹4.2 crores) a pop. A few years ago, Buffett had said, “I can gear my whole life by the price of Berkshire.”

What he probably meant was that his entire adult life revolved around building Berkshire Hathaway into the behemoth that it is today. And every little milestone in his life can be tied easily to the price of Berkshire’s shares.

The day he bought his first car — He knows Berkshire’s price was X.

The day he bought his first house — He’s well aware that Berkshire’s price was Y.

The day his first child was born — He has it etched in his memory that Berkshire’s price was Z.

Sure, you could argue that even after a stock split, you can assign the prevailing price to a milestone. But it’s just not the same emotionally. The share price isn’t really growing alongside the growth in your life.

For instance, let’s say the price of the stock was $500 while buying a car. But then a month later, you decided to conduct a 5:1 split. The price falls to $100. And then you have your first child. It kind of loses that sentimental value, doesn’t it?

Maybe the same can be said about MRF too.

See, the company was founded in 1946 and went public in 1961. Today, it’s the third generation of the family who holds the reigns to this tyre empire. The current MD Rahul Mammen is the 44-year old-grandson of the founder of MRF. And that means Rahul Mammen’s whole life has been geared to the stock. Right from when he was an infant. His growth is mirrored by the growth of the stock. And that could be quite sentimental, no?

Or maybe it’s something else entirely. Maybe it’s vanity?

A few years ago, Sanjay Bakshi, who was then an Adjunct Professor at Management Development Institute, Gurgaon wrote an article about MRF. And he used the idea of the peacock’s tail to explain his thinking. He said that although the peacock’s tail was extremely beautiful, it could be a handicap because its weight and length could slow down the bird when it has to escape from predators. The tail makes its life more difficult.

Sidebar: This is not necessarily true. Studies show that the tail doesn’t weigh down a peacock all that much when it flees. Also, its predators are colour blind and can’t actually see the brilliant plumage.

But let’s go with this handicap principle.

Now apparently, if a peacock is able to survive in the wild with the most beautiful and long tail, it sends a message to its female counterpart. That it is able to survive against all odds. That despite having the handicap of this bothersome tail that can attract predators, it is still winning the fight. And that handicap actually makes the peacock seem more attractive for mating purposes. The big tail signals ‘high quality’.

Probably that makes this peacock quite vain too?

So Professor Bakshi’s question was — does MRF’s high stock price over the long term also work like a peacock’s tail and signal high quality to potential investors?

Well, he believes that it just might be the case.

Because investors might assume that it’s going to be hard for a stock to jump from ₹10,000 to ₹11,000. That the additional ₹1,000 of upwards movement will probably take effort and time. They might believe that it’s easier for a stock to rise from ₹100 to ₹110. It’s just ₹10 after all.

People tend to look at this movements in absolute terms. Even if effectively, both indicate a 10% rise in price. And so they believe that it will require more energy to push an already ‘high-priced’ stock even higher. It’s a handicap.

The end result of this could be that only high-quality and discerning investors might choose to put their money into such high-priced stocks. The others stay away. And maybe that’s just the kind of investors that MRF wants too. The ones who’re attracted by its ‘handicap’ of high price. The ones who believe that MRF actually signals high quality.

Or put another way, maybe MRF is actually using its high price to select the set of investors it desires?

Again, let’s look at Warren Buffet’s thinking about this. Here’s what he wrote way back in 1983 in a letter to shareholders when Berkshire Hathaway was trading at $1,300.

Were we to split the stock or take other actions focusing on stock price rather than business value, we would attract an entering class of buyers inferior to the exiting class of sellers…Those who think so and who would buy the stock because of the split or in anticipation of one would definitely downgrade the quality of our present shareholder group.

There’s some vanity in there, no?

And this high price creates a cult in itself. Cult = vanity?

Just to be clear, we don’t know the real reason as to why MRF didn’t split its shares. We’re just hypothesizing here. We could be completely wrong.

But tell us — what do you think?

Until then...

Don’t forget to share this article on Twitter and WhatsApp.

PS: You know how we mentioned that the great Warren Buffett has never split the Berkshire Hathaway shares?

Well, that’s true…but only partially.

You see, Berkshire Hathaway actually has a second type of share that’s listed on the stock markets. It’s called the ‘B-shares’. It issued this cheaper version of its share in 1996. And then issued a 50:1 split way back in 2010 too.

But hey, since the main Berkshire Hathaway shares have never been split, the legend continues.

A message from one of our customers

Nearly 83% of Indian millennials don't have term life insurance!!!

The reason?

Well, some think it's too expensive. Others haven't even heard of it. And the rest fear spam calls and the misselling of insurance products.

But a term policy is crucial for nearly every Indian household. When you buy a term insurance product, you pay a small fee every year to protect your downside.

And in the event of your passing, the insurance company pays out a large sum of money to your family or your loved ones. In fact, if you're young, you can get a policy with 1 Cr+ cover at a nominal premium of just 10k a year.

But who can you trust with buying a term plan?

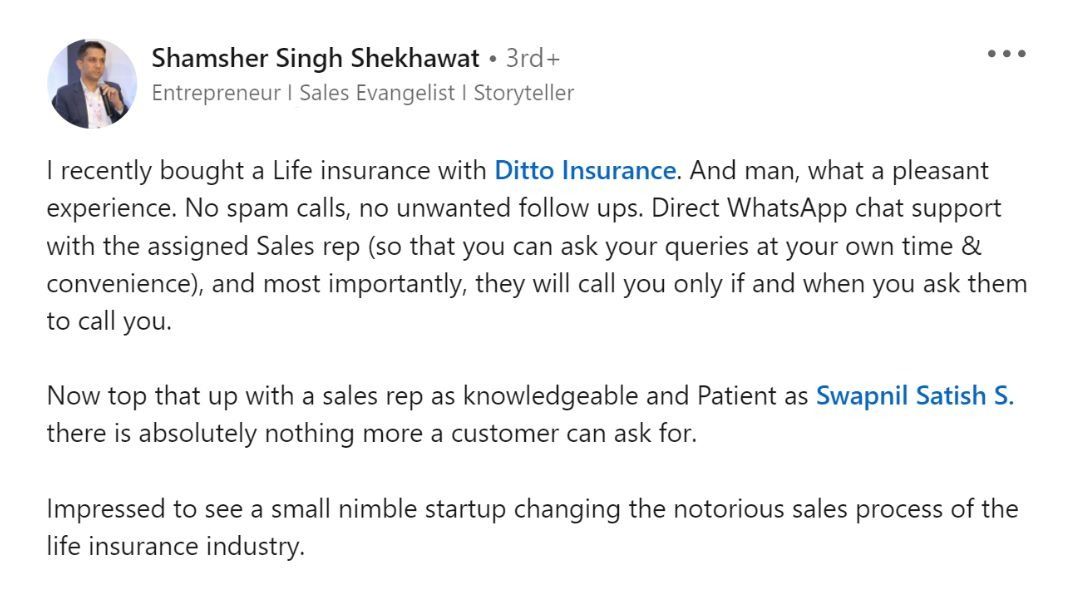

Well, Shamsher - the gentleman who left the above review- spoke to Ditto.

Ditto offered him:

- Spam-free advice

- 100% Free consultation

- Direct WhatsApp support for any urgent requirements

You too can talk to Ditto's advisors now, by clicking the link here