In today's Finshots we see why the Nobel Committee awarded the Sveriges Riksbank Prize in Economic Sciences to Bernanke, Diamond and Dybvig

But before we get to today’s story, if you’re someone who loves to keep tabs on what’s going on in the world of business and finance — why aren’t you subscribed yet? We’ll send you this newsletter every morning with crisp financial insights straight to your inbox. Subscribe now!

If you’re already a subscriber or you’re reading this on the app, you can just go ahead and read the story.

The Story

Why should a bank exist?

It’s a trivial question in some ways. But not so trivial if you’re an economist.

Before 1980, banks were primarily thought of as intermediaries connecting borrowers and lenders. This relationship was assumed. But in assuming the obvious, economists failed to formally establish their role in the economy — in aiding growth and in crippling it.

This is most apparent when you consider the discourse surrounding the Great Depression.

Between 1929 and 1933, total economic output in the United States fell by nearly 30%. During the same period, the unemployment rate rose from 3% to nearly 25%. It was an economic collapse of epic proportions.

Initially, most economists pinned the blame on reckless investments and mass infrastructure spending. The argument was that people invested in these assets in the hope of extracting a king’s ransom, only to find out that they didn’t hold as much promise as originally envisioned. And when those expectations soured, the eventual crash led to what we now know as the Great Depression.

Stock prices tanked. Wages declined. And the economy cratered. But banks didn’t feature in this explanation.

However, in 1963, Milton Friedman and Anna Schwartz offered a more elaborate explanation — one that radically transformed our understanding of the Great Depression. They believed that “money supply” was at the centre of it all.

Their argument went something like this — The central bank at the time decided to counter the crisis by raising interest rates. They believed this would prevent reckless stock market investors from borrowing and investing money in speculative assets. And it did. However, the increase in the interest rate also choked off “money supply”. Individuals and businesses couldn’t borrow money even if they desperately needed it. This affected economic output and eventually exacerbated the depression.

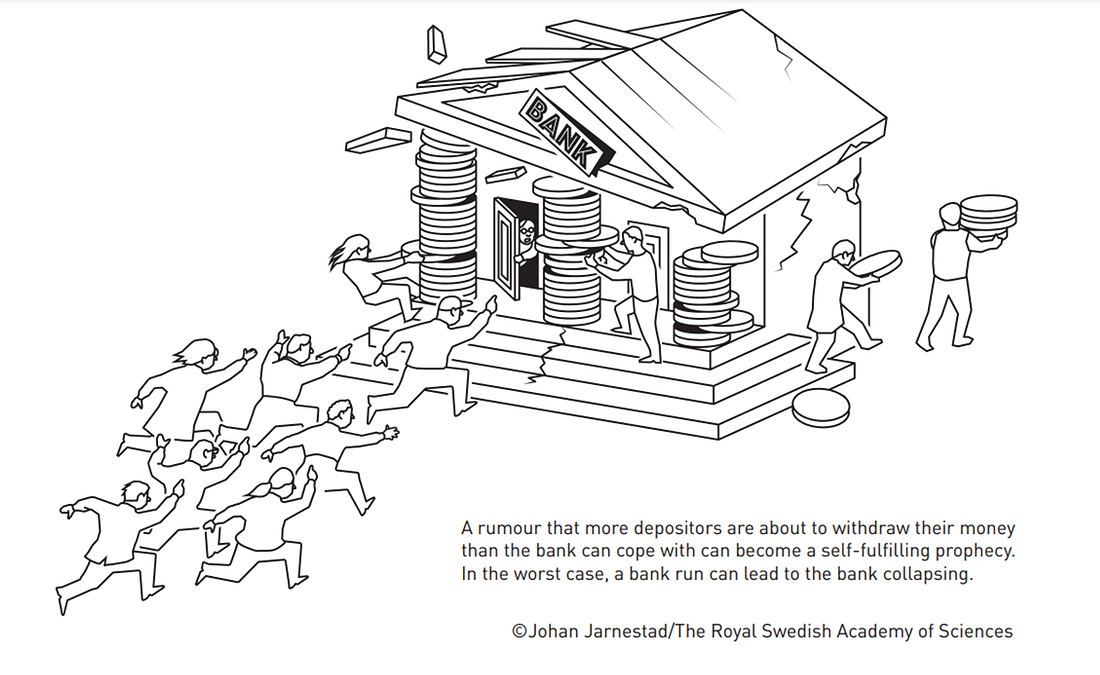

Alongside this, you also had fragility in the banking system. A sense of panic crept in. People were worried about their deposits. They weren’t entirely sure if the banks could come good on their commitment. And as the hysteria grew, people withdrew their funds en masse and banks began tumbling like dominoes. The few surviving banking institutions laid off employees and scaled-down operations. The total money supply took a beating once again.

Now this explanation was extremely convincing. It formally recognised the importance of the banking system and it showed how bank failures were in some ways responsible for the Great Depression. But it still didn’t capture the full extent of the banking system's involvement in aiding/hampering economic output.

Until 1983, when Ben Bernanke would offer another complementary view of why banks were central to the crisis. “It wasn’t just the money supply”, he said. The failure of the banking system also imposed a cost on both lenders and borrowers. Without banks, a small business owner would have great difficulty sourcing funds at an attractive interest rate. A pensioner with a few hundred dollars wouldn’t be able to channel their savings to “good borrowers”. And Bernanke showed how this collapse in banking relationships could affect economic output.

In summary — “Banks must survive an economic recession. If they don’t, the recession could soon give way to a catastrophe.”

Soon, two other economists, Diamond and Dybvig would build on this and formally establish the role banks assume in an economy. In other words, they showed why banks exist in the first place.

For instance, if depositors only cared about a return on investment, they’d find those avenues themselves. You could, in principle, extend a loan to a real estate developer and extract a sizeable return on your investment. But you don’t do this. Instead, you go to a bank. You go to a bank because you expect to access your funds on short notice, even if the bank sets it aside elsewhere.

They extend easy access to your funds and a return on your investment. They set aside only a small portion of your deposits and use the rest to extend long-term loans. Sure, they won’t always have the money to pay back everyone, if everyone demanded it at once. But they know that it is unlikely to happen and this assumption works pretty well in most cases.

But what if there was a bank run? What if people panicked and sought their deposits all at the same time?

Then yes, banks would be in trouble.

But Diamond and Dybvig also showed how “deposit insurance” could prevent such an eventuality. They showed how a simple promise from a third party to fully (or partially) cover your deposit in the event of a bank failure could prevent people from making mass withdrawals.

And while this may all sound intuitive, Diamond and Dybvig formally established this relationship using mathematical models.

It probably doesn’t make a lot of sense to you right now. But let me offer another example.

In “Principia Mathematics”, Bertrand Russell and Alfred North Whitehead would describe a proof, starting from the very basic axioms, that 1+1=2. It would take them 360 pages to do so. In establishing this very basic relationship, they’d describe what ‘1’, ‘2’, ‘plus’, and ‘equals’ actually mean using formal logic.

And while Bernanke, Diamond and Dybvig didn’t exactly formalize the very tenets of economics, they did establish the mathematical foundation to study and understand banking systems. As the Nobel Committee writes — “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.”

That’s why they won the Nobel Prize.

Until next time...

Note: There’s been some criticism directed towards Ben Bernanke since the announcement, considering he was the chair of the Federal Reserve during the 2008 Financial crisis. Many believe that his policies were responsible for exacerbating the recession.

Also, if you know anyone who's been wondering who got the Nobel Prize in economics this year and why they got it, don't forget to share this simple article with them on WhatsApp, LinkedIn and Twitter

Ditto Insights: How you can boost your term insurance coverage?

Feel like your term plan cover isn’t enough?

Unfortunately, regular term plans don’t allow you to increase your cover. But life is unpredictable (and so is inflation), so here are a few ways you can boost your cover in case you need to:

1) Buy an additional term plan.

The most obvious answer is — buy another one. Just keep in mind that doing so means you will have to go through the entire documentation process again. And as you age or develop health problems, your eligibility criteria is compromised.

Therefore, it’s probably in your best interest to buy a larger term plan to begin with, so you can avoid managing two policies at once.

2) Opt for a life-stage benefit rider.

You can opt for a ‘life stage benefit’ while buying your term insurance. This add-on allows you to increase your cover by a certain amount during major life events. For instance, getting married or having kids. It’s a great tool to maximise your benefits and it’s this kind of flexibility that you should be looking for in a good term insurance policy.

And hey, if you’re wondering what’s the best course of action for you, talk to us at Ditto for free.

1. Just head to our website — Link here

2. Click on “Book a FREE call”

3. Select “Term Insurance”

4. Choose the date & time as per your convenience and RELAX!

Our advisors will take it from there!