On January 1st SEBI ordered billionaire Mukesh Ambani and his conglomerate Reliance Industries Ltd. to pay a combined penalty of Rs 40 crores for alleged manipulative and fraudulent trading in the month of November 2007. And if you’re wondering why the regulator imposed such a harsh penalty, here’s our simplified take on what happened during the fateful month.

The Story

During the first week of November 2007, 12 entities — all connected to Reliance Industries Limited decided to bet against Reliance Petroleum limited.

Yes, there was once a Reliance Petroleum Limited (RPL) and it was a refinery, partly owned by Reliance Industries Limited — the big daddy. Anyway, the 12 agents decided to bet against RPL using what is called a futures contract. In this context, it means, the agents were hoping to make a windfall on the back of a steep decline in RPL’s stock price.

Now futures are devilishly complicated financial instruments. And in the interest of keeping this story simple, I urge you to bear with me — We will not go into the details here. But remember— The steeper the decline in stock price, the more money the agents were standing to make. And if the stock price rallied, they were looking at losing a lot of money as well. So you have to have a fair bit of gumption to make such a trade.

Unless… you knew for certain that the stock price was poised to tumble — Which is what SEBI believes actually happened.

On November 29, 2007, just 10 minutes before the end of trading, Reliance Industries limited sold close to 2 crore shares of RPL. The selling triggered mass panic and within a moment’s notice, the stock price collapsed. This also happened to be the same day that the futures contracts were meant to payout. So SEBI contests that RIL and the agents colluded together in a bid to profit off of this transaction. How much money did they make?

Rs 447 crores according to the regulator!

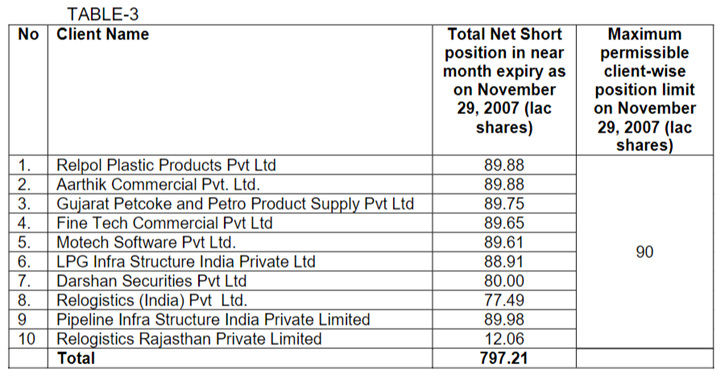

Now bear in mind making such trades isn’t illegal per se. But the thing is — The agents hadn’t disclosed their relationship with RIL when placing their bets, giving regular retail investors the impression that these were independent trades made by random people not associated with RIL. That is a bit dubious. But there is more — Together they were trading volumes far beyond the permissible limit.

Now the counsel for RIL argued that this is a farce. None of them had individually breached the limits imposed by SEBI — except for two agents, which was dealt with. But everybody else had stayed within the threshold — almost suspiciously close might I add.

However, SEBI refused to look at the equation this way. They knew the 12 agents were acting at the behest of Reliance Industries Limited. They knew they could only make trades authorized by RIL. So even if they hadn’t breached the limits at the individual level, they most certainly did so as a group. And since RIL had no authority to trade such large volumes, it was illegal for them to ask the agents to do so.

As the adjudicator noted —

The Hon’ble Supreme Court of India has held that-“what cannot be done directly cannot be done indirectly by engaging another…”

But RIL had one more defence. See, the company had already decided to sell shares of Reliance Petroleum Limited in a board meeting earlier. They were doing this in a bid to raise some extra money and it was perfectly legal for them to do so. But here’s the thing — At the time they believed RPL’s stock price was overvalued and they knew that if it suffered a sharp erosion in value, they wouldn’t have been able to raise the money they originally intended. So they claimed they were simply asking their agents to trade those futures just so that they could make some extra money in the event the stock price did collapse.

Offsetting their losses.

Protecting their downside.

“Hedging,” their bets so to speak.

But SEBI notes that there is no documentary evidence to support this claim. As they write in the judgement —

“It is also clear from the submissions of RIL that it did not draw up a hedging policy... It is also a matter of surprise, that in a large corporate of the size of RIL, major operations in the market are not guided by an approved policy plan, which will minimize the scope for individualistic discretions to come into play”

So clearly SEBI wasn’t buying this argument. And back in 2017, the regulator mandated RIL and its agents to pay Rs 1,000 crores for their misdeeds. In addition, the Friday’s judgment imposes an additional penalty on RIL, Mukesh Ambani and two other entities. Now this one is a bit tricky because RIL has always contested that two senior officers were responsible for the trades. They argued that Mukesh Ambani had nothing to do with this. But once again, SEBI refused to acknowledge this assessment. Referring to a Supreme Court Judgement, the adjudicator noted — “The prefix ‘Managing’ to the word ‘Director’ makes it clear that they were in charge of and are responsible to the company, for the conduct of the business of the company” and went on to add—

“In view of the foregoing, I find that Noticee-2 [Mukesh Ambani] is deliberately trying to shift the blame of manipulative trades by RIL on the said two officers. I am of the view that Noticee-2, being the Managing Director of the RIL, cannot absolve himself and plead ignorance about the entire scheme of manipulative transactions undertaken for the benefit of RIL.”

And in the end, imposed fines of Rs 25 crores and Rs 15 crores on Reliance Industries Ltd. and Ambani, respectively.

This is our first Finshots Daily of the year. So if you liked this article or you know anyone who's interested in these kinds of stories, don't forget to share (Links for WhatsApp, Twitter and LinkedIn)