In this week’s wrapup, we talk about the narrative fallacy and how it precipitated a spectacular rally in the Chinese markets

The Narrative Fallacy

Humans have an innate desire to connect dots and make sense of the world around us. To this end, we construct flimsy accounts of the past and create stories that can easily explain outcomes.

As an article in the Farnam Street notes — It’s implicit in how we understand the world. When the coffee cup falls, we need to know why it fell (We knocked it over). If someone gets the job instead of us, we need to know why they were deemed better (They had more experience, they were more likable). Without a deep search for reasons, we would go around with blinders on, one thing simply happening after another. The world does not make sense without cause-and-effect.

And this feature of storytelling forms a key part of the human psyche. It’s wired in our DNA. However, there is a tiny problem with this whole scheme.

It’s particularly susceptible to exploitation.

Back in 2014–15, China’s stock market went on a spectacular rally. A rally so phenomenal that people couldn’t believe what they were seeing. Every day the market kept making new highs and it seemed like anybody could make money betting on stocks. However, this rally wasn’t necessarily premised on sound fundamentals. There were no structural government reforms. There wasn’t a drastic improvement on the economic front. And China’s GDP wasn’t exactly booming either. Instead, the market rally was primarily driven by state propaganda.

The Chinese state media began constructing elaborate narratives about a growth spurt in the economy. They weaved stories around concept stocks — fledgling companies that had the potential to change entire industries. Big themes were touted including President Xi’s “New Silk Road” infrastructure blueprint for Asia and Europe — a project meant to connect various parts of the world to promote trade and commerce. They kept telling everyone how easy it was to invest and make money trading stocks with prosperity right around the corner.

And people eventually started buying into this narrative. The rally was now being rationalized. Millions of retail investors kept accumulating stocks en mass. Many quit their jobs to pursue investing as a full-time profession. High school students started betting using spare cash. Housewives, farmers, street hustlers — everybody got in on the act. A survey revealed that more than 60% of new investors that entered the stock markets during the period didn’t even have a high-school education.

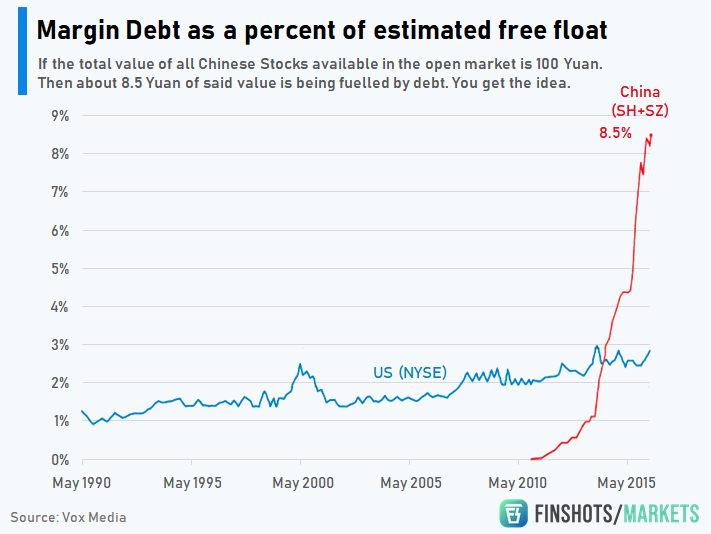

And the government remained an active participant all along. Regulations were diluted. They relaxed norms for margin trading — a mechanism where you buy shares using borrowed money.

Imagine this — People betting ludicrous amounts of money using borrowed cash. It can’t possibly end well, can it?

In fact, some even borrowed money beyond permissible limits through unregulated channels — small online lenders, trust loans etc. The euphoria was real. The Shanghai Composite Index — a group of stocks supposed to represent the Chinese markets, rose by 150% in a few months. You had more than 40 million account openings between June 2014 and June 2015.

It was getting out of hand.

Eventually, the government had to crack down on margin lending. For the first time in almost a year, it seemed like the government wanted to tame the bull. And investors feared the worst. They panicked — selling stocks at throwaway prices. They knew the rally wasn’t going to last long. The markets tumbled 40% in just 2 weeks and the inevitable crash followed soon after.

That was 2015.

And people think it might be happening again.

Right now!!!

Now obviously this isn’t to say that Chinese markets are rallying today without rhyme or reason. After all, stocks were trading at steep discounts during COVID and China is slowly opening up its economy. But, the optimism is slowly devolving into a frenzy.

As an article in the The Economist notes —

Chinese media are swinging into cheerleading mode, one of the tell-tale signs of past episodes of irrational exuberance. “The clicking of the bull’s hooves is a beautiful sound for our post-virus era,” declared a front-page editorial in the China Securities Journal, a state-run paper, on July 6th. The Shanghai Securities, its sister paper, was less poetic but more direct in an article posted online on July 3rd: “Hahahahaha! It looks more and more like a bull market!”

In the meantime, the Shanghai Index has surged by more than 35% to reach 5-year highs without a significant rise in company earnings. Margin trading is seeing an uptick, currently at 1.27 trillion Yuan ($184 billion), highest since January 2016, and of course, you can’t rule out state intervention right now.

But why would the government want to incentivize people to prop up the markets? After all, if all of this explodes as it did back in 2015, that wouldn’t bode well for anyone, right?

Right!!!

But the government does have other perverse incentives. When there aren’t enough avenues to grow the economy, the state turns to unconventional methods. Back in 2015, the government was hoping for a revival in confidence by propping up the markets. They wanted to further the “Chinese dream” and help turn the tide. After all, if people could earn and create wealth with booming markets, that would, in turn, rejuvenate demand. People would spend. People would consume. You could kick off a virtuous cycle of growth.

More importantly, a rally in the domestic stock market convinces people to invest locally as opposed to seeking foreign markets. It reduces money outflows. It can help in so many ways. Unfortunately, it’s not easy to tame financial markets. The frenzy can get out of hand very quickly and any intervention after this could potentially have catastrophic consequences for everyone involved.

The bottom line — markets don’t drive the economy. The economy might drive the markets, but that’s about it. And if you commit the egregious error of pumping stocks using state intervention, that’s a recipe for disaster. As The Economist succinctly put it —

“Healthy bulls need only a diet of grass. Injecting them with steroids is an invitation to trouble.”

Lemonade and the Trust Game

Also, quick question — Do you think humans are innately trustworthy?

Consider a game — You receive $100. You can either choose to keep it or offer it to a stranger. If you offer it to the stranger, the money will instantly quadruple and the stranger will receive $400. At this point, the stranger can decide to keep all the money or return half of it back to you.

If you ask standard economists, what the stranger is likely to do here — they’ll tell you that the stranger will maximize his own utility and keep the entire $400. They’ll tell you there’s no need to reciprocate since returning half the money makes no economic sense. Yet when you conduct this type of experiment with real people, the results are often counter intuitive.

Most people who get the $100 immediately send the money to the stranger and the people that play the role of the strangers often return half the money to the original recipient i.e. humans reciprocate.

When someone does something nice for us, we feel compelled to return the favour, often in a similar way, and it comes very naturally.

And there’s a remarkable insurance company in the US trying to build a business centered on this rather simple premise. So on Thursday, we wrote about Lemonade and its blockbuster IPO. Do read the entire story now

The Remarkable Insurance Company Lemonade