In today’s Finshots, we’re not talking about a stock. We’re not talking about an industry. Instead, we’re taking the microscope to a sub-niche market — fried chicken.

The Story

What’s the first thing that comes to your mind when we say ‘fried chicken’?

KFC, probably.

The American brand first entered India in 1995. Shortly after the massive wave of liberalisation. And it has ruled the fried chicken roost since then.

Okay, saying that it ruled the roost since 1995 might be a bit of a stretch because the initial years were quite tough for KFC. It was actually forced to exit the market quickly because people launched protests complaining that the company used chemicals in its chicken. And even after KFC sorted things out and made a comeback in 1999, the going was tough. By 2005, it had just 7 outlets.

Now before you say, “Well, that’s probably because India is a predominantly vegetarian country,” let’s dispel that myth. Because it’s really not. See, 70% of Indians eat some form of meat or the other. And most of them prefer chicken. So the market was there for the taking. It’s just that maybe Indians hadn’t caught on to eating spiceless buckets of chicken just yet. Maybe our taste buds hadn’t quite gone global.

So KFC decided that it needed to work with people who understood India’s taste buds better. And it doubled down on the franchise route. This meant that KFC would find and offer an Indian partner the exclusive right to use its brand name. This franchisee would sell KFC’s products. And in return, they would pay a royalty or part of the profits back to KFC.

And it’s one of the easiest ways for a Western brand to establish a presence in another country without risking a lot. The brand doesn’t need to start from scratch. They don’t have to worry about local tastes and preferences. Just find a partner with experience and money, work together on tweaking some products, and voila — the stores will be up and running in no time.

It worked. Indians slowly began to embrace KFC. Maybe our tastebuds had changed by then too. And stores started popping up everywhere.

Now KFC didn’t want its fortunes in India to be linked with one partner alone. So it diversified. It found one franchise partner for the north and east. And another partner for the south and west. Although these partners have changed over the years, today, almost every KFC store in India is run by two listed franchisee companies — Devyani International and Sapphire Foods.

Anyway, despite KFC’s success, none of the other big fast-food chains stepped on KFC’s turf for many years. Fried chicken was synonymous with KFC. Sure, there were local copycats like BFC and CFC, but they weren’t a real threat to the American brand. And Sapphire Foods and Devyani International who had divvied up India into their mini KFC kingdoms had free reign.

But then, KFC’s rivals realized something.

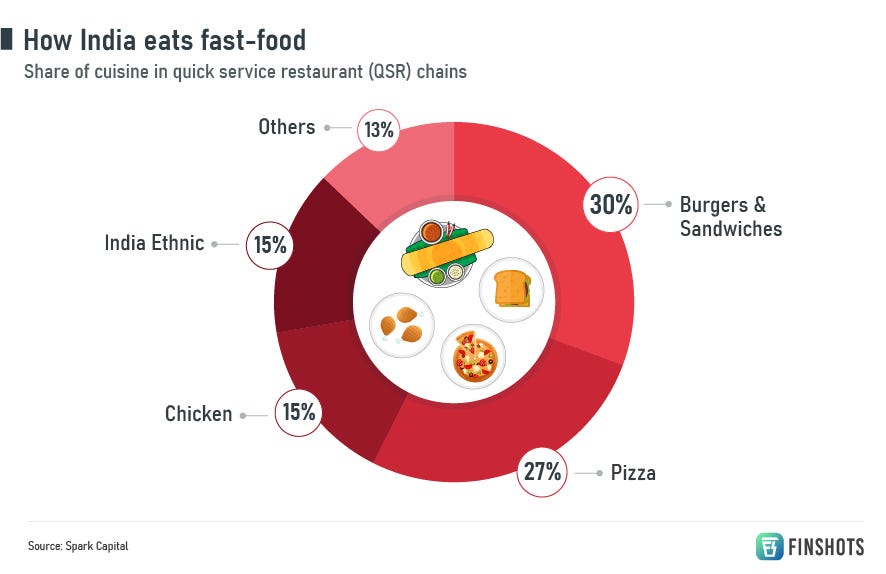

Sure, Indians might love burgers and pizzas. But people were slowly turning to fried chicken to meet their fast food cravings. It had slowly climbed up the ladder and snagged a 15% wallet share in the quick service chain restaurant pie. And this could grow much further. Because as per Mirae Asset Capital Markets’ estimates, the ₹50 billion fried chicken category in India has grown by 18% annually in the past five years. Much faster than the widely-loved pizza market - which by the way has been experiencing a bit of a slump.

And you just need to look at Devyani International to see this playing out. The average daily sales (ADS) at a KFC store is now 3 times higher than that of Pizza Hut as per Kotak Securities.

Fried chicken had arrived!

That’s when KFC’s rivals decided to disrupt the status quo. They were looking at all this data closely and wanted a bite too.

At first, there was Westlife Foodworld.

Now if you haven’t heard of them, let’s just say that they own the franchise rights to McDonald’s in the south and west of India. So if you go to a McD in Bengaluru, you know it’s Westlife that handles the operations. Anyway, Westlife knew that most Indians ate chicken. But they weren’t stupid. They realized the average numbers didn’t mean squat. That the geographical disparity was immense in India. For instance, in Gujarat, only 40% of people said they ate meat.

So in 2020, when they launched the McSpicy Fried Chicken, they targeted only the south. Their blog said, “a tailor-made product for the South market.” It was an experiment.

An experiment that worked. People flocked to McDonald’s. Not just for the burgers. But for the fried chicken. And The Ken says that within a couple of years, the McSpicy Fried Chicken contributed to 10% of Westlife’s revenues in the south.

That’s quite a crazy number for a ‘burger’ company!

And this success might’ve inspired another global player to make a fried chicken trip to India. Some might say an even bigger one than McDonald’s. We’re talking about Popeyes.

Wait…what’s Popeyes?

Well, it’s another fried chicken and sandwich brand from the US. But when we say bigger player, we don’t mean in terms of the brand. In the Indian context, it’s about the company that has brought Popeyes to India — Jubilant FoodWorks. Yup, the ones that had the franchise rights to Domino’s in India and made it into the pizza behemoth also snagged the franchise rights for Popeyes.

And just like Westlife, Jubilant’s focusing squarely on the south for now. It chose Bengaluru for its first 12 outlets. And it’s now slowly testing the waters in Chennai. It knows the market.

Even brokerages are getting excited by India’s love for fried chicken. In fact, when ICICI Securities published a report on Jubilant FoodWorks a couple of weeks, they actually headlined it “Popeyes: Right ingredients for significant rampup (some impact for KFC is inevitable)”. Yeah, they think Popeyes can contribute massively to the future of Jubilant.

So this brings us to the question — will KFC’s fried chicken monopoly be broken?

It’s really hard to say. For starters, some people point to McDonald’s’ early success in selling fried chicken. They think it’s an indicator of trouble for KFC. If a burger chain can do it, then other speciality fried chicken brands like Popeyes could be an even bigger threat they say.

Others point to the flavour aspect at Popeyes — the unique ‘Cajun’ flavour that’s apparently a first in Indian QSR. They think this alone can lure people away from KFC.

And a few highlight the delivery aspect. Because for a long time, fried chicken was considered to be a dine-in product. But Covid changed everything. People wanted to satiate their cravings at home. And in the past few years, the contribution of the delivery segment has jumped from just 11% to 40%. But KFC depends on aggregators like Zomato and Swiggy to do the deed. They don’t control the experience. Popeyes, on the other hand, can simply rely on Jubilant’s prowess and experience in running Dominos. And who knows, if they’re able to perfect quick delivery as stores grow in number, that could snatch away demand from KFC too.

But despite all this, it’s probably not really game over for KFC and its Indian showrunners Devyani International and Sapphire Foods.

And that’s because the standard argument applies even for fried chicken — low penetration. For instance, according to research from Spark Capital, there’s only 1 KFC store for every 770,000 people in India. On the other hand, there’s Mexico and Indonesia which have a store for every 225,000 people.

Also, as India’s aspirations and incomes keep growing, the chain QSR space will take up a larger wallet share than the measly 4% it commands now. Maybe it’s not about taking a slice of the pie but growing the pie itself.

So yeah, if you’re looking to take a bite of this fried chicken market, you’ve got quite a feast now. You have the OGs Devyani International and Sapphire Foods. And the newbies Westlife Foodworld and Jubilant FoodWorks. You just have to decide who will take the crown.

Until then…

Don't forget to share this article on WhatsApp, LinkedIn and Twitter