This stock keeps moving up every time we take a peek at it. So in this week's Finshots Markets, we see what’s happening with Deepak Nitrite once again.

The Story

We’ve already covered Deepak Nitrite in the past. But we can’t delve into this story without offering a brief overview.

Deepak Nitrite makes chemicals. There’s basic chemicals i.e. bulk products like Sodium Nitrite and Toluene with low margins. There’s specialty chemicals — high-margin products manufactured in low quantities. And performance products — chemicals that add certain unique characteristics to a product. And while the company is a market leader in some of these segments, it only began to blossom very recently.

But this story isn’t about a blossoming Deepak Nitrite. This story is about a company that’s setting the world of chemical manufacturing on fire. No pun intended.

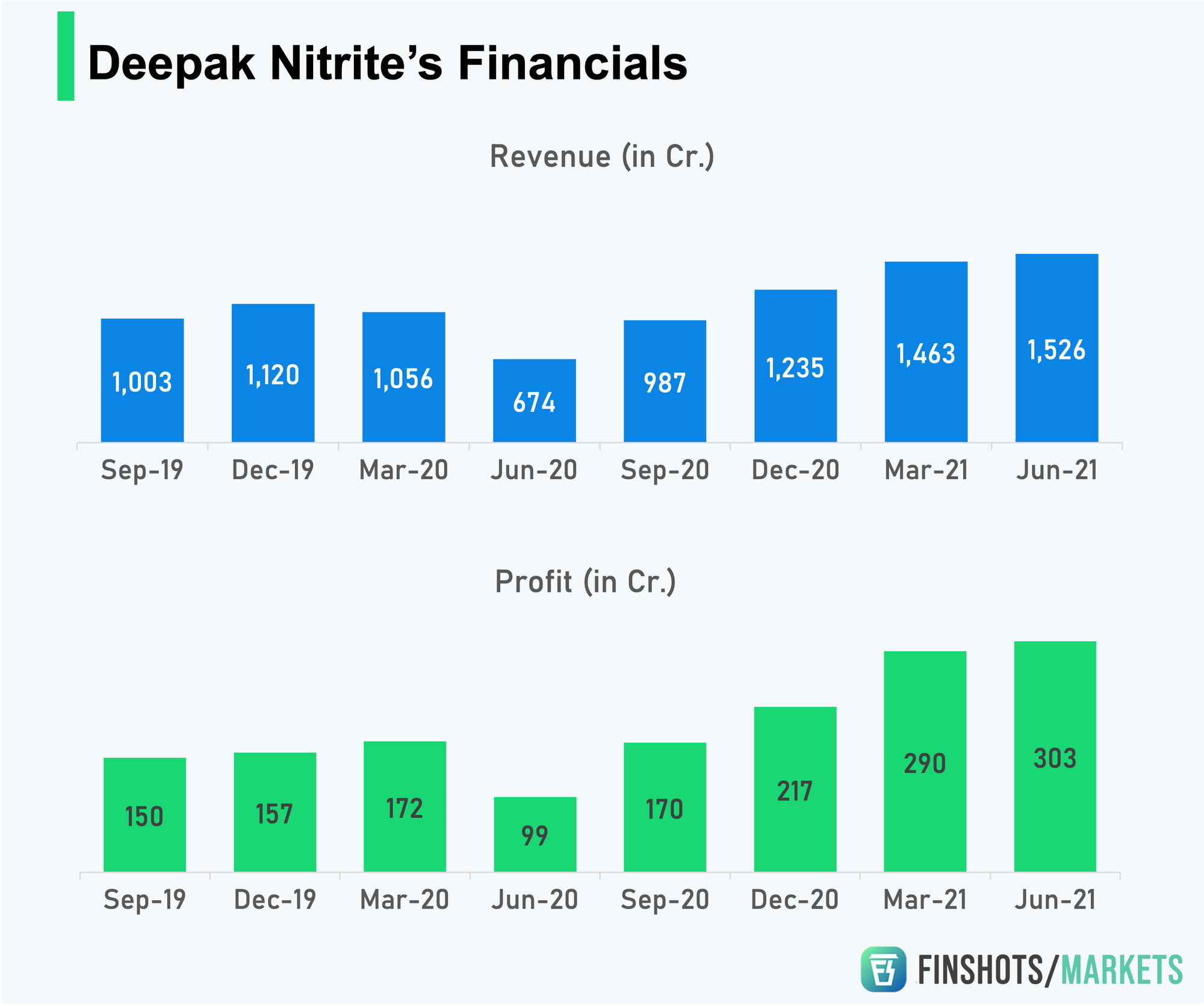

If you haven’t heard already, this is what the company’s results from the first quarter look like.

Revenues from the basic chemicals segment stood at ₹249 crores as opposed to ₹153 crores during the same period last year. Revenues from the specialty chemicals department stood at ₹207 crores as opposed to ₹140 crores. And revenues from performance products stood at ₹93 crores as opposed to ₹61 crores when compared to the first quarter of the last financial year. And if these numbers weren’t impressive, there’s the wholly-owned subsidiary — Deepak Phenolics, a company that’s responsible for churning out Phenol and Acetone.

Revenues, here, grew by 200% and they made close to ₹1000 crores this quarter alone. Their production facilities were running at utilization levels of close to 110%. And in a pandemic year, where lockdowns were commonplace, these numbers truly look remarkable which is why everybody’s sort of going — “What’s happening at Deepak Nitrite?”

Well, it’s not so much about what’s happening at Deepak Nitrite as opposed to what’s happening outside it. Take for instance Phenol. This compound is used in the manufacture of Epoxy resin, Phenolic resin, and Polycarbonates. And demand for these items has been quite robust these past few months.

Why? you ask.

Well, because of pent-up demand. Consider construction. A lot of people couldn’t invest in buying new homes last year. However, as the threat from the virus slowly abated, these people were looking for new homes in the market — all at the same time. As a consequence, construction activity picked up in a big way. And all of a sudden there was a demand for items like epoxy resin and polycarbonates — benefiting the likes of Deepak Nitrite.

Then there’s the fact that Taiwan Xinchang Chemical (a major producer of phenol and acetone) just announced that they are cutting down production due to a crunch in Benzene supply — a key raw material used to produce Phenol. Meanwhile, the Chinese government is still hell-bent on closing polluting plants — most of which happen to be chemical manufacturing companies. And when you consider the fact that there are so few specialty chemical manufacturers out there, you can probably see why there’s so much optimism surrounding Deepak Nitrite.

Also, it’s not like the company is sitting on its laurels. They’re also planning to invest close to ₹300 crores in developing agrochemicals and pharmaceutical intermediaries. And while they may not have a lot of expertise on this front, this could be a new revenue driver for the future.

Bottom line — Deepak Nitrite has everything going for it. Demand for most products is through the roof. And there’s an opportunity to extract high margins from chemicals that are seemingly in short supply.

Unfortunately, this has got some people betting heavily on the company. They can see the way the stock keeps moving and they want to ride this wave. But perhaps it makes sense to exercise a bit of caution. Look, Deepak Nitrite is undoubtedly on a purple patch like no other. Having said that, however, you should be aware that fortunes can seemingly turn overnight in this line of business. A few Chinese manufacturers and a reversal in demand could dent Phenol prices moving forward. The new expansion plans may not pan out as intended. So when you’re betting big on companies like Deepak Nitrite, take a moment to recognize all the things that could go wrong.

And if you have some apprehension, then maybe it makes sense to take a step back and re-evaluate your priorities. Until then…

Share this article on WhatsApp, and Twitter.

What does the GDP growth figure tell us?

We also talked about how India’s GDP grew by a whopping 20.1% during the first quarter of FY2022, in this week’s Finshots Daily. So if you’re interested in this sort of this, don’t forget to read the full article.

What does the GDP growth figure tell us?