Simple. No nonsense. To the point. That's the premise of this newsletter and to prove this bit, we are going to work with a rather monotonous topic- Moratoriums and try to make it more readable :)

So here goes ...

Give me a Break!!!

Moratorium is a big word. It’s a complicated word. It means a suspension of some activity during a said period. And on March 27th, the Reserve Bank of India suspended all loan repayments due in March, April, and May 2020. And then, a few days ago, the Reserve Bank did it once again and extended the moratorium by another 3 months, until August 2020.

The only problem— This assessment is inaccurate. Because the RBI didn't suspend anything. Instead it asked banks (nicely) to give people the option to defer loan and interest payments for three months.

It isn't a Maafi. It isn't a waiver. It is simply a postponement of sorts.

You’re not getting a discount on your repayments. You’re still expected to pay in full once the moratorium concludes. And monthly interest will keep accruing during the said period. But it does give you some wiggle room, especially if you don’t have the cash to keep paying your EMIs right now.

But the thing is...

When the RBI originally prodded banks and other financial institutions to offer moratoriums to their customers, there was an expectation that these institutions wouldn’t comply. After all, why would banks willfully let people delay repayments when there’s no explicit mandate from the RBI.

But this was dodgy analysis. Because if financial institutions hadn’t let people avail this benefit, you’d have started seeing defaults across the board. Defaults that wouldn’t have happened if they were simply allowed more breathing room. So there was every incentive for entities to extend the benevolence to end customers and they did just that.

Big private sector banks like Axis, ICICI, and Kotak seem to have 25–30% of their loan book under moratorium right now. Meaning between March and May, they will neither receive interest nor the principal payments from this part of the loan book. But other banks like Ujjivan and Equitas — who primarily dabble with microloans have customers availing moratoriums from all corners.

The primary difference between large private banks and the likes of Ujjivan seems to be the customer profile. Whilst private banks lend to big corporates who might have the necessary resources to keep paying their EMIs, Ujjivan is mandated to extend a portion of its loans to the rural unbanked.

And it doesn’t take a genius to tell you why these people might not have the necessary recourse to keep making repayments right now.

FYI, that’s precisely why Ujjivan is not a regular bank. It’s what we call a Small Finance Bank. But it’s not just banks and small finance banks that are feeling the pinch. Shadow banks have had to take a hit as well.

A Speed Bump?

Consider Bajaj Finance. It’s a shadow bank or more formally addressed as a Non-Banking Financial Institution(NBFC). And unlike banks that do a bit of everything, NBFCs are slightly more specialised. For instance, Bajaj Finance specialises in consumer durable loans. The kind of loans that help you buy electronic items, household appliances, etc. You get the idea.

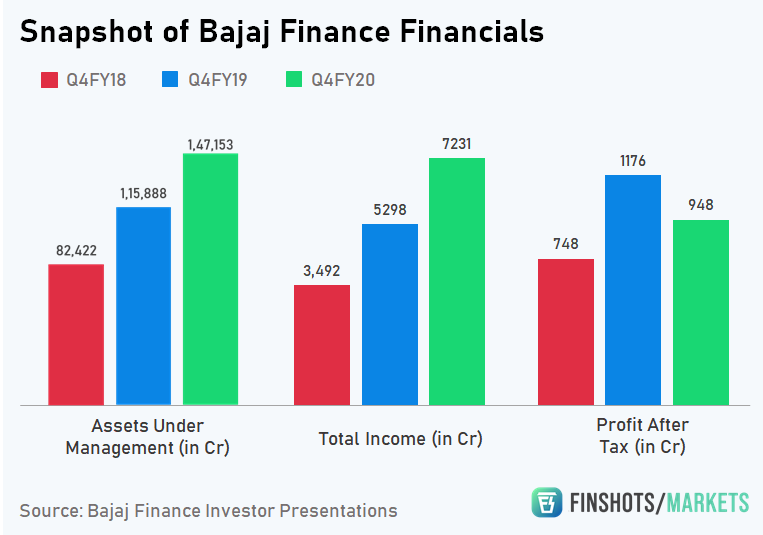

Now bear in mind, Bajaj Finance is one of the most acclaimed NBFCs in the country. They’ve grown at a blistering pace and they’ve been doing it pretty consistently. But if you take one good look at the results last quarter (between Jan and Mar 2020), you’ll see how everything is changing.

The Inside Story

- Profits were down 20% compared to the quarter last year — primarily owing to impairment charges. That’s Bajaj Finance telling you they no longer think they’ll be able to recover Rs.1865 crores from their customers, most likely attributable to the pandemic.

- Considering repayments are likely to take a hit, they’ve also promised to tighten lending norms. Fewer loans disbursed=Gloomy growth prospects

- And they’ve appointed close to 2800 officers in a bid to retrieve unpaid dues/loans in full. So it’s easy to see how the company has switched from growth mode to recovery mode.

The Final Takeaway

So investors will now have to keep a keen eye on what happens when the moratorium period concludes, come August. Because that’s when you can truly gauge the impact of this crisis. Will there be more bad/unpaid loans to contend with? Almost certainly. Will the bad loans cripple financial institutions in this country? We don’t know.

Hopefully not :(

Also, here is a quote that summarises the state of NBFCs in this country

“Just when you feel like it is safe to go back to the water, the shark comes along again”

— Rashesh Shah, Chairman, Edelweiss (NBFC)

Also, in other news, airlines have finally resumed operations. And we’ve got a story on the airline industry that will make go — “Whaaaaaaaaaaat!!!”

Okay, maybe that’s a bit of an exaggeration but it’s a solid read. So do check it out

An explainer on the lopsided economics of running an airline.